Weak consumer confidence, falling retail sales and the threat of Amazon are contributing to a "difficult" year in Australia for ad spend, says media agency Zenith, releasing its latest industry forecasts.

Globally, stronger-than-expected internet advertising will drive 4.7% growth in total ad spend in 2019, according to Zenith’s Advertising Expenditure Forecasts.

That’s substantially ahead of the 4% forecast made in the previous edition of the report published in December. Zenith forecasts 4.6% growth in both 2020 and 2021, ahead of previous forecasts of 4.2% and 4.1% growth respectively.

But growth is expected to be weaker in Australia. Zenith forecasts ad spend to grow to USD13.5 billion in 2021 from USD12.4 in 2018, representing about 3% growth each year.

Over that time Australia's global ranking will fall to tenth, from ninth, largest ad market in the world.

2019 is looking to be a difficult year in Australia, says Zenith, pointing to consumer confidence dropping to its lowest level since September 2017, retail sales below expectations in December and January, and the threat of Amazon.

At the same time, the financial services sector is feeling the impact from the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry,.

And both NSW and Federal elections are taking place in the first half of the year. Tradtionally, while political advertising spend rises, corporates hold back on spend until after polling.

“All things considered, from an advertiser perspective we anticipate any potential leap towards austerity being countered by the fight to maintain market share, particularly in the retail and auto sectors," Zenith Sydney head of investment Elizabeth Baker says.

"Government advertising has also started to enter the market and will be felt across TV and radio in particular.

“Similarly, domestic banks will have to re-enter the advertising market later in the year as they seek to regain trust and mitigate customer switching in the wake of the Royal Commission."

In Australia, Zenith forecasts that digital’s share of the adspend pie will exceed 60% by 2021.

However, there will be some slowing in growth across search, display advertising but will still be strong. According to the IAB’s 2018 report, display adspend increased 15.8% in 2018, a clear signal of the health of the medium.

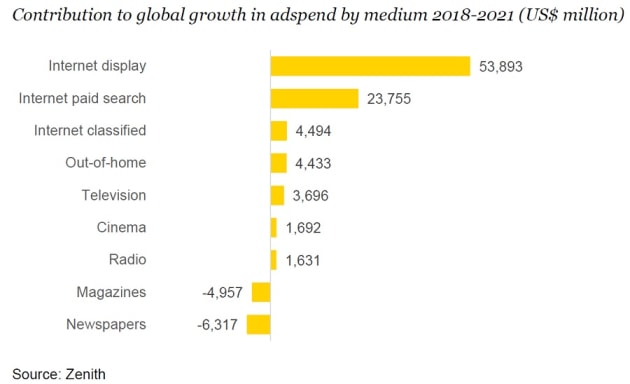

Globally, Zenith has upgraded its forecasts after internet ad spend markedly exceeded expectations in 2018.

In dollar terms, Zenith upped its estimate of the internet total in 2018 from USD231 billion to USD246 billion.

Zenith is now forecasting an average of 10% growth a year to 2021 for internet advertising, up from previous forecasts of 9%.

This growth is being driven by the overlapping channels of online video and social media, which are expected to grow by 19% and 14% a year to 2021 respectively.

A large proportion of the growth in internet advertising – and therefore the ad market as a whole – is currently coming from small businesses, such as local shops, restaurants, and hobby stores.

Platforms such as Google and Facebook have opened the ad market up to many small businesses for the first time, by offering simple self-serve tools to create ads and manage campaigns, and provide the localisation and targeting they need to reach their limited potential customer base, converting customers effectively.

The latest Zenith forecasts:

Australia's global ranking:

Have something to say on this? Share your views in the comments section below. Or if you have a news story or tip-off, drop us a line at adnews@yaffa.com.au

Sign up to the AdNews newsletter, like us on Facebook or follow us on Twitter for breaking stories and campaigns throughout the day.