Private equity firms are increasingly pumping money into acquiring media agencies.

Those most likely to get a call about a possible buy are independents with some scale, such as 100 plus staff.

Private equity strategy is to grow the value of the business threefold over five years and then exit.

"The digital and marketing services landscape is witnessing a remarkable shift, driven by the influx of PE (private equity) capital and innovative business strategies," says Joe Hine, partner at global M&A advisory firm SI Partners.

In study of the 60 PE investments in digital and marketing services since 2010, SI Partners found that three quarters were made in the last five years.

And the acceleration in investment is marked by and build strategies. Agencies, with PE investment, tend to buy other agencies using PE cash to quickly gain growth.

And this happens fast. Half (54%) the PE backed companies made an acquisition within their first year.

Exits typically involved a sale to another financial buyer after an average holding period of 4.6 years, with the acquired company experiencing an average 200% increase in headcount.

SI Partners says 2024 will be a crucial test for PE, with one-third of the analysed companies expected to seek an exit.

A prime example of a buy and build strategy is UK-based Brainlabs, an agency founded in 2012.

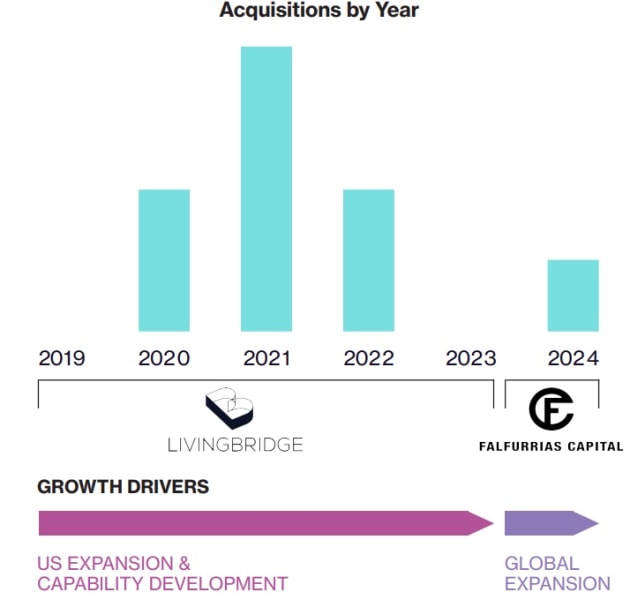

Brainlabs received investment from private equity firm Livingbridge in 2019 for a reported 40% stake with an organic and buy and build strategy.

Over the next four years, Brainlabs acquired eight businesses. And in September last year, PE firm Falfurrias Capital invested in the business, reportedly valuing it at £256 million (AUD495 million).

Brainlabs in January this year bought Australian independent Sparro, founded by brothers Morris and Cameron Bryant.

Sparro has a team of more than 110 and handles $200 million of annual media spend for clients including Estée Lauder Companies, Catch, Temple & Webster, Petbarn, Webjet and Destination NSW.

The deal included social-first content and creative agency Jack Nimble, run by founders Angus Mullane and Adam Wise, which Sparro bought in 2021.

The Brainlabs journey, via private equity, according to SI Partners:

Have something to say on this? Share your views in the comments section below. Or if you have a news story or tip-off, drop us a line at adnews@yaffa.com.au

Sign up to the AdNews newsletter, like us on Facebook or follow us on Twitter for breaking stories and campaigns throughout the day.