Digital pure-play advertising group S4 Capital posted its first negative growth year, with technology companies pulling back on advertising spend.

Martin Sorrell’s company expects more of the same this year, with negative growth and cost cutting.

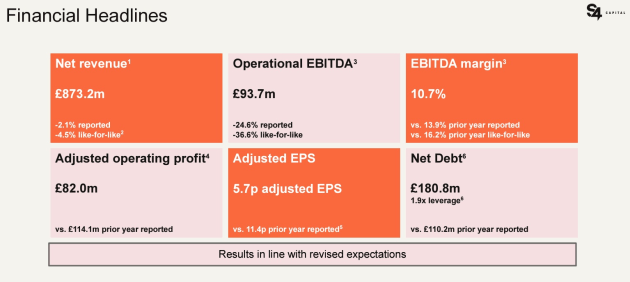

In the year to December, net revenue was down 4.5% like-for-like to £873.2 million, reflecting challenging macroeconomic conditions and cautious spending from clients.

This compares to four strong years: like-for-like net revenue growth of 44% in 2019, 19.4% in 2020, 43.7% in 2021 and 25.9% in 2022.

The company cut headcount 13% to 7,707 and says it continues to manage costs tightly, given the “uncertain” market outlook.

Most global advertising groups have reported a difficult year with clients in the technology sector. Dentsu posted 2023 growth at -4.9%, WPP a "resilient" 0.9%, IPG 1.7%, Omnicom 4.4% and Publicis Groupe 6.3%.

S4 Capital said it saw longer sales cycles, most evident in content with some technology clients, a reduction in smaller project-based assignments and with local and regional clients.

Net revenue for the content practice was down 10% like-for-like.

However, the final results for 2023 were in line with revised targets.

“We had a difficult 2023 reflecting challenging global macroeconomic conditions, fears of recession and high interest rates,” said Sir Martin, founder and executive chairman of S4Capital.

“This resulted in client caution to commit and extended sales cycles, particularly for larger projects, a difficult year for new business, as well as spend reductions from some regional and smaller client relationships.

“We saw better relative performance and continued resilience in our top 20 and top 50 clients, with our ten largest client relationships strong.

“We took significant actions to reduce costs in the year and maintain a disciplined approach to operational efficiency.”

He said 2024 is likely to be weighted to the second half, aided by lower interest rates and the impact of artificial intelligence initiatives.

“We remain confident that our talent, business model, strategy and scaled client relationships position us well for above average growth in the longer term, with an emphasis on deploying free cash flow to boost shareowner returns,” he said.

Growth rates in digital media and transformation markets remain above those of traditional, analogue markets, the company said.

“We are mainly focused on these two digital markets and are at the heart of developing trends around AI, Quantum Computing, the Metaverse and Blockchain for marketing,” S4 told the London Stock Exchange.

“We are starting to see traction from our AI initiatives: clients are engaging us for workshops, audits and strategic advice and almost all our presentations and new engagements involve AI in one way or another.

“In early 2024 we launched Monks.Flow, an AI-centric professional managed service and the initial response is encouraging - we believe this product will be an essential differentiator for us as clients move from testing to full-scale adoption of AI.”

The company is restructuring its board to look more like other listed companies with non-executive directors.

Executives Christopher S. Martin, Victor Knaap, Wes ter Haar and Scott Spirit have all agreed to retire from the board at the next annual general meeting.

Management consultant Jean-Benoit Berty, a former senior partner at Ernst & Young, has been appointed chief operating officer.

The 2023 full year numbers:

Have something to say on this? Share your views in the comments section below. Or if you have a news story or tip-off, drop us a line at adnews@yaffa.com.au

Sign up to the AdNews newsletter, like us on Facebook or follow us on Twitter for breaking stories and campaigns throughout the day.