- WPP’s organic growth was down 1.4% in the second quarter, better than an expected 3% fall.

- The company reported a “steady stream” of client wins including UK top 5 advertiser L’Oréa.

- Stronger client retention with no significant client losses since October last year.

WPP, the world’s biggest advertising company with a string of agencies including GroupM and Ogilvy, reported better than expected revenue on the back of major new business wins.

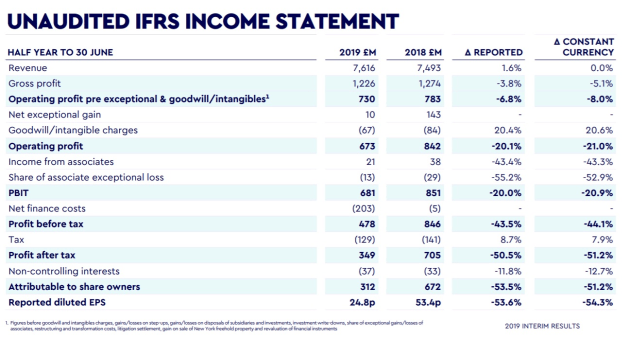

Revenue was GBP7.616 billion for the six months to June compared to GBP7.493 billion for the same half last year.

For the second quarter, revenue less pass-through costs -- a widely used metric to measure growth -- was down 1.4%. Analysts had expected a 3% fall on top of 2.8% in the first quarter.

Profit after tax was down by half to GBP349 million, mainly because of an exceptional gain in the same six months last year.

The stock market loved the results. WPP shares closed more than 7% higher in London Friday.

The company is only eight months into a three-year turnaround plan following the departure last year of founder Sir Martin Sorrell.

The company says its business this year is still heavily impacted by client losses from the beginning of last year through until September 2018.

But business has picked up.

“This year we've seen strong client retention,” CEO Mark Read told a briefing of analysts. “We haven't really lost a major client during 2019 and we've had a solid string of new business wins, really from the beginning of the year.”

However, WPP is sticking with its full year guidance of like for like revenue down 1.5% to 2% compared to last year.

“We do have encouraging areas of growth in our media businesses group and have performed extremely well,” says Read.

“We continue to see strong growth from our technology clients that make up in substantial part of our portfolio, and some of the faster growing economies in some choppiness in China, but Brazil and India where we have large businesses have done well.

“We have started to take or have taken the initiatives that we believe we need in terms of bringing in new leadership, re-organising or repositioning the company through the creation of VMLY&R, Wunderman Thompson, BCW, and we're starting to see a positive impact of those mergers.”

The US, where revenue slipped 5.4% in the second quarter, remains a key focus area, the company says. This was an improvement on the first quarter when revenue in the US dropped 8.5%.

Revenue in the UK was up 1.3% in the quarter compared to a 0.9% loss in the first three months.

Read says the second quarter was slightly ahead of internal expectations but in line with full-year guidance and three-year targets.

“Clients are responding well to our new offer, as evidenced by recent wins and expanded assignments including from eBay, Instagram and L’Oréal,” Read says.

Growth areas include big tech clients (up 16%) and luxury goods (up 7%).

First half wins include digital-first agency Essence with L’Oréal UK/Ireland, a top five UK advertiser, with $US150 million in billings.

Ogilvy grabbed Instagram’s global account and more than $US30 million in billings. Wavemaker has $US350 million in billings from Huawei in China.

Since July, the big win was by MediaCom which secured eBay in the US and China with $US250 million in billings.

“An encouraging number of our businesses and markets are achieving good growth,” Read says.

“That said, we are still in the early stages of our three-year turnaround plan, and we remain focused on returning the company to sustainable growth over that period. Our guidance for the full year is unchanged.”

WPP has sold 44 business units over 15 months, simplifying the company and positioning it for future growth.

The company is selling a majority stake in Kantar to Bain Capital Private Equity for GBP2.5 billion (AUD4.48 billion). The cash will be used to pay down debt and to return capital to shareholders.

“The progress we have made and the positive new business momentum are reasons for optimism,” Read says.

“As a creative transformation company with stronger, more tech-enabled agencies, we are well placed for the future as clients look for modern partners to help them navigate an increasingly complex and challenging marketing landscape.”

Australia results were not released. The company’s local entity, WPP AUNZ, is due to report to the ASX this month.

The WPP Plc first half 2019 numbers in detail:

Have something to say on this? Share your views in the comments section below. Or if you have a news story or tip-off, drop us a line at adnews@yaffa.com.au

Sign up to the AdNews newsletter, like us on Facebook or follow us on Twitter for breaking stories and campaigns throughout the day.