Publicis Groupe topped the 2019 global marketing services industry league table for acquisitions.

Consulting firm R3 assessed 489 M&A deals in the marketing services sector over the year to December with $US27.7 billion invested overall, a 15% fall on the previous year.

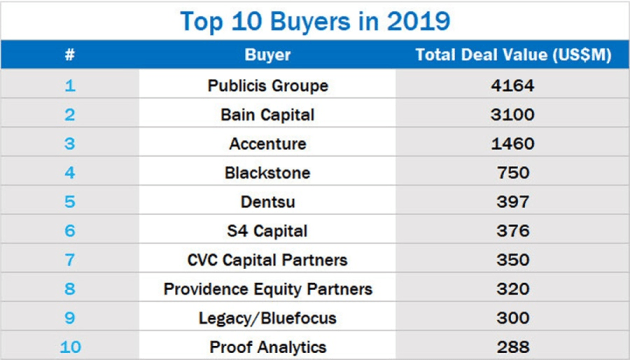

Publicis was number one in the world with an estimated $US4.16 billion spend, up 8%.

Its big buy was data-driven marketing company, Epsilon, from Alliance Data Systems Corporation for $US3.95 billion.

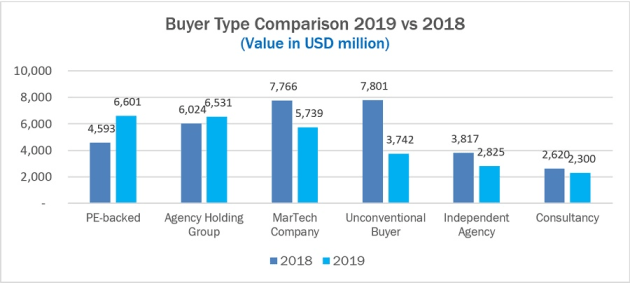

Holding companies pulled back on the number of deals, which fell by more than half. However, total spend year-on-year was constant.

While Publicis Groupe was the top buyer, Dentsu did more deals with the total number of transactions at 12.

“Restructuring has shifted attention away from volume and forced holding companies to attend to integration,” says Greg Paull, principal at R3.

“It’s been about what’s going to help win new business.”

The top 10:

The top 10 deals in 2019 included data and research (Kantar, JD Power), retail and customer experience (Triad, Rightpoint) and CEO consulting (Teneo).

“Buyers have been looking at investments that will strengthen their position in an uncertain geopolitical climate,” says Paull.

“Though martech and adtech have driven M&A value, there has been more interest in acquisitions that will increase regional presence and serviceability.”

North America led M&A value at $US19.9 billion.

Private equity groups contributed 44% in deal value globally ($6.6 billion).

“The ‘buy and build’ strategy of cash-rich PE-backed agencies over the past few years has kept the M&A landscape buzzing,” Paull says.

“We expect to see continued PE investment in marketing services in the new year, though transactions are likely to be more modest.”

Martech companies were the most active buyers, increasing the number of deals made by 68% as they look to expand capability into analytics, email and search.

The number of deals in APAC slipped by 9%, with value falling further by 55%.

“Investment in APAC has slowed though it remains of interest to buyers wanting to address marketplace complexity in the region,” says Paull.

Have something to say on this? Share your views in the comments section below. Or if you have a news story or tip-off, drop us a line at adnews@yaffa.com.au

Sign up to the AdNews newsletter, like us on Facebook or follow us on Twitter for breaking stories and campaigns throughout the day.